What is LongView?

LongView is an initiative of Freshagenda drawing on insights from our global dairy market analysis and related influences on the inputs and outputs from global supply chains.

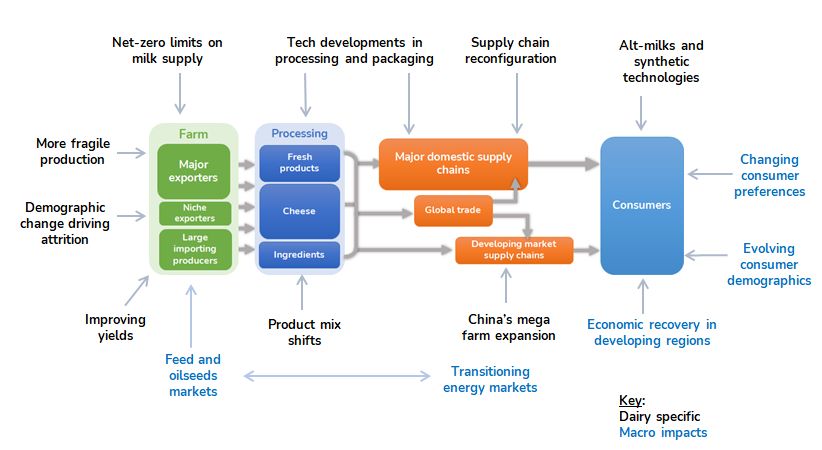

The LongView Dairy platform draws on a wide set of dynamic influences that will over time shape demand and supply parameters pertinent to dairy value chains from farm inputs through to consumer markets.

LongView provides a framework to explore future scenarios for the global dairy industry which can be used to guide and test strategy. It provides relevance to participants operating across the dairy value chain as we as those who invest, provide technology, and make policy – not only in dairy but in connected to the array of input and output categories.

The platform draws on:

Our continuous monitoring of developments and expectations in the outlook for macroeconomics, geopolitics, trade policy, environment and climate policy, consumer trends, innovation, and commodity markets

Freshagenda’s existing Global Dairy Directions platform of insights, data and analysis of the short-term global and regional outlook for dairy markets, which includes its Dairy Trade Simulator

High-level monitoring of grains, oilseed, energy, and other related commodity markets.

Opinion from collaborators from our analysis and client networks.

Why LongView?

LongView challenges people to look beyond the tangle of the short-term.

Community sensitivity to resource-intensive animal industries is growing. We are seeing compelling evidence of the environment and economic pressure that is building in major developed dairy producers that will limit or reduce milk production – especially in Europe and New Zealand, the two big exporters of dairy commodities. In both regions it is now widely expected that there will be meaningful reductions in dairy herds.

In the US, it appears to be the only major producer capable of structurally growing its dairy output, given the scale of its large farm units.

Meanwhile the dairy category is threatened by younger consumers quickly shifting preferences to plant-based alternatives, and products made using on cellular technologies will gain further momentum as their unit costs are inevitably reduced. These will not only erode fresh milk and product sales, but also eat into the most important category – natural cheese.

The developing world will add 660m people to 2030, ensuring demand will be sustained, as there is almost limitless requirement for daily dairy nutrition, growing as incomes and livelihoods improve. Processing technology and innovation will accelerate to improve the functionality and affordability of nutrition products.

China meanwhile is not only expanding into a more complex consumer market, but is attempting to reduce its future reliance of imported dairy ingredients, ploughing billions of yuan into new large-scale dairy facilities that will ensure their milk supply rapidly expands to meet their demand.

Global geopolitics has reshaped alliances and trade connectivity. The massive effects of COVID on behavior and macroeconomic settings will alter the landscape for much of the coming decade. At the same time, the mounting pressure for dairy supply chains to contribute to big cuts in carbon emissions by 2030 will contribute to the constraints on dairy herds.

How do all these changes shake out over the next decade? How will these and other big levers of change alter the global milk balance and what could this mean for the affordability of dairy nutrition to the expanding markets for dairy nutrition. What possible scenarios could evolve and what risks and opportunities might be available for producers, processors, marketers and investors?

LongView provides a framework for users to navigate these and other issues, put them into context and come to terms with their meaning and potential effect.

How is this different?

Our innovation

The LongView is unique because:

- It provides an extensive narrative describing the future scenarios facing the dairy sector

- We are transparent in providing the underlying simulation tool to client users as part of the service

- Our continuous process of update and extension, drawing on insights, intelligences and data updates from global sources

- Scenario evolve and adapt as necessary – expanding and deep-diving to take account of new and emerging developments

- The attention to detail adds rigour – it takes account of how value is determined in the major milksheds

Freshagenda

The core skills lie in interpreting industry, market and supply conditions and their outlook for decision makers.

The Freshagenda Global Dairy Directions platform which incorporates the DTS is the only comprehensive commercial service that dynamically models the supply & demand fundamentals of dairy commodity markets on global and regional bases.