Outline

These reflect the crossroads which global food sectors face.

The connectivity theme is relevant given the potential for further erosion of globalisation, and the impact of this on trade policy and collaboration on several important development agendas such as sustainability and social equity. The ultimate extent of the dislocation may vary widely, and indeed challenging events such as COVID-19 and war in Eastern Europe may refocus humanity into a phase of greater harmony.

The second dimension reflects the choices the world faces as to how food will be produced and supplied and what will drive consumer preferences. On this spectrum are choices between feeding the burgeoning populations for survival with whatever resources are required, or seeking a long-term sustainable outcome in terms of not only the resources used, their impact on the planet and all its species including diets that societies prefer.

Macro

Economic

- The global economic recovery will be uneven over the first half of the 2020s due to the depth of COVID’s impacts on many developing countries and the inequitable access to vaccinations. Price sensitivity will become a greater challenge in the short-term in both worlds.

- Money will remain cheap for some time – low interest rates will likely remain low until there is sufficient recovery in capacity to soak up the ocean of money printed by the world’s central banks to stimulate recovery.

- Energy markets are in transition towards a greater role for renewables and natural gas as coal and crude oil wane. Crude oil markets will continue to recover in the short-term (to 2023 or 2024) with managed supply while demand rebuilds. Demand will peak in 5-8 years as the energy mix changes.

- Feed grain and oilseed values will remain elevated for at least the short-term (subject to weather) due to increased food security and protectionism.

Innovation

- The aftermath of the pandemic will drive innovation in food products, in response to altered consumption patterns arising from resetting work life patterns in developed economies and re-urbanization in developing regions.

- New business models will break up traditional silos in long supply chains to bring producers closer to marketers and end-users.

- Advancing knowledge systems will more rapidly mine and capitalise on consumer and supply chain intel.

- More complex consumer wants and preferences – propelled by digital influences to greater health consciousness – will reflect the evolving demographic shifts.

- Steadily rising affluence in the developing world is improving livelihoods and lifting incomes while gradually aging.

Themes

Our methodologies

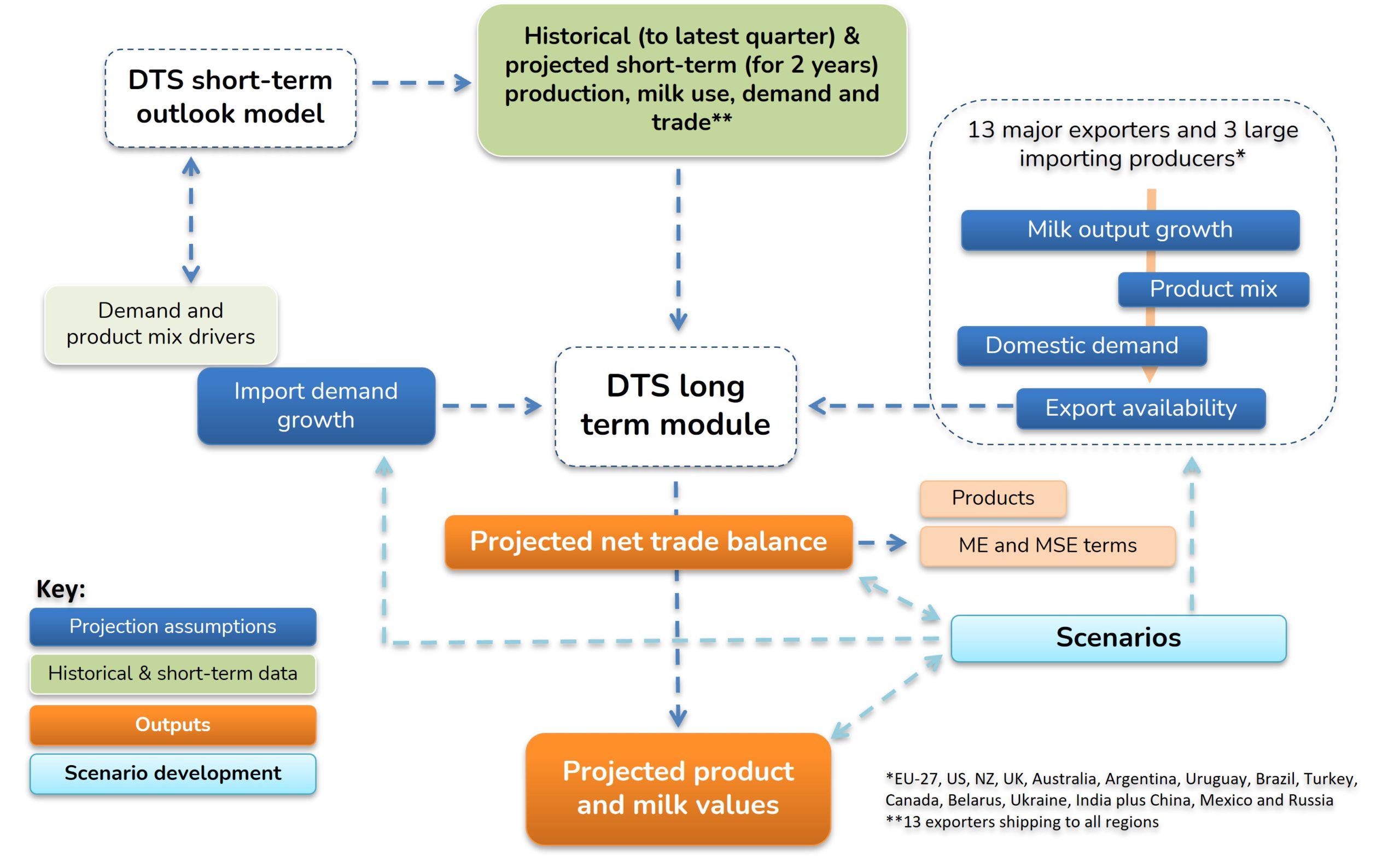

Historical balance sheets are developed by producer and commodity, extended into global markets with historical trade data by commodity category.

These are extended in the short-term (for up to two years) on a monthly basis drawing from the DTS, using the most recent quarterly global analysis. The projection is annualized from the 3rd year of the outlook through 2035.

The Freshagenda DTS uses econometric modelling to develop “projected fundamental values” for dairy commodities.

We study influences on historical prices using multi-factor regression analysis and selective machine-learning techniques, which draw on the commercial reality of relative influences and interconnections of the value of commodities produced in the major global milk sheds.

The same principles are extended to the LongView DTS for the development of projected commodity values, simplified into quarterly modelling to cater for the seasonality of production and trade.

The scenarios developed in LongView are based on distinctly divergent views of the future applied to the dairy complex drawing on contemporaneous consideration of macro, geopolitical, consumer, energy and climate policy trends.

The consequences of these views are translated into assumptions for dairy production, product mix, consumer demand and trade in those future scenarios.

Contact us for more information of the modelling used in this process.

Data and intelligence

The internet catalyzed a metamorphosis in all businesses, while open source and SaaS technologies are furthering an exponential change in the market intelligence business.

Converting data to information and insight, once computationally difficult, is now relatively lower effort.

As a result, information asymmetry between participants in origins (markets with structural surpluses) and developing destination markets (with nutritional deficits) has changed, both in its magnitude and composition.

The consumers of the 2020s are increasingly more informed and aware, ensuring businesses are making decisions with very different constraints than in the past. Food supply chains will continue to evolve with far more complex drivers.

The dairy sector is not an exception to the evolution, with the determinants of competitive advantage evolving rapidly.

With the broad availability of data, intelligence has fast become both the art and science in isolating insights that are relevant to the levers a particular business can pull. By that token one size may not fit all.

Scenarios

The scenarios in the Longview have been developed using axes that reflect the forces which drive the major uncertainties faced in the future – dimensions of the extent of global market connectivity and the priorities in managing resources.

These reflect the crossroads which global food sectors face.

The connectivity theme is relevant due to the potential further erosion of globalisation, and the impact this would have on trade policy and collaboration on several important development agendas. The ultimate extent of the dislocation may vary widely, and indeed challenging events such as COVID-19 may refocus humanity into a phase of greater harmony.

On the second dimension reflects the choices the world faces as to how food will be produced and supplied and what will drive consumer preferences. On this spectrum are the choices between feeding the burgeoning populations for survival with whatever resources are required, or seeking a long-term sustainable outcome in terms of not only the resources used, their impact on the planet and all its species including diets that societies prefer.

Read more about each scenario:

Scenario 1 Scenario 2 Scenario 3 Scenario 4